September 26, 2012

Daily Comment

I reached a milestone today.

I checked my account, and find myself to be, for the first time, debt-free.

If you exclude home mortgage loans (and two auto loans, the second one of which was repaid by 1996), I was debt-free from 1979 (when I paid off a small student loan that originated in 1977) to 2005. I started taking on debt when I got married for the second time (although, without going into more debt myself, I paid off all my fiance's loans before we were married on Christmas Day, 2004). At that time, thanks to investments and stock options I got in 2001, my net worth was in the 6-figure range.

Four years later, I was unemployed, homeless, and deep in debt. In October of 2008, when I had moved to Syracuse (3 months earlier), rented an apartment, unpacked and bought some new, needed household goods, I took stock and found myself with about $13,000 of credit card and $17,000 student loan debt from my failed attempt at Nursing school.

No magic, and not painless. Here's how I did it: I made a budget.

I figured out my bottom-line cost of living, looked at the difference between that and my take-home pay, and used about 90% of that for loan repayment. I did a one-time prioritization of the loans, in size order, smallest at the top, student loan at the bottom. I paid twice the minimum payment on every loan except the top priority loan (the one with the smallest amount); the lowest balance loan got all the remaining loan repayment money.

All tax refunds, and any extra income I made, went to loan repayment. I paid back loan after loan this way, and on Monday, I retired the student loan, just short of 3 years after I did my original budget.

I got my first credit card, from Barney's, when I was sixteen years old (1966, if you're keeping score). I freaked out when I got my first bill and saw how much interest I was paying (no interest-free repayment period in those days). For the rest of my life, I did everything I could do to avoid credit card debt. Debt just felt wrong to me.

Like most people in the industrialized world, I have a complicated and highly emotional relationship with personal finances - although I would bet that a huge majority choose to deal with this primarily by paying it no attention.

I could never go that route. I used budget software as soon as it was available (Dollars and $ense, 1984). I did my own taxes as soon as the first version of TurboTax was made available. I got into the habit of keeping track of all my expenses. Very OCD of me. All right, not so much OCD as anal retentive. Or maybe they're the same.

How did this strange behavior came about? There were childhood influences, like feeling I (my family) was the poorest among my friends; having a financially astute grandmother who was similarly obsessed, and always fighting with my mother (frequently, about money); and watching my father declare bankruptcy after his first heart attack).

But, mainly, I think it was because of my own life-long struggle with impulse control. I got myself into financial troubles a few times in my mid-to-latet-20s. At times, these problems caused enough stress to give me an anxiety attack. Putting attention on my personal finances helped.

I have a lot of gratitude for all the forces and influences that have somehow managed to get me to this place, so near the end of my working career. I admit, it is a good feeling to know that I have paid off every financial debt I have ever had. I wish all my debts could be accounted for that way, but there are some debts you can never repay. But, they're not financial.

Please leave a comment if you visit my blog. Thank you!

Food and Diet Section

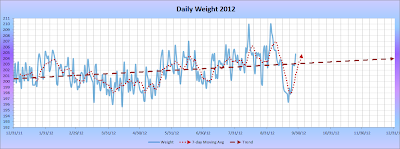

Today's Weight: 204.8 lbs

Yesterday's Weight: 202.8 lbs

Day Net Loss/Gain: + 2.0 lbs

|

| Year 2012 daily weight from December 31, 2011 |

Diet Comment

Ugh. Yesterday's off-plan snacking plus late night feeding did real damage this time. I have to cut back. Also, start drinking more water.

Food Log

Breakfast

Chia gel.

Lunch

at Ling-Ling Chinese Buffet:

|

| The stnadard: kimchee and, from the "Mongolian Grill" chicken, pork, bean sprouts, cabbage, onions, peppers, broccoli, mushrooms in a chili sauce with hot pepper sauce. |

Dinner

Liquid Intake

Coffee: 22 oz, Water: 100+ oz.

Please leave a comment if you visit my blog. Thank you!

1 Comments:

That is amazing. Good job. Love you

Post a Comment

Subscribe to Post Comments [Atom]

<< Home